5 Managements with vision for Growth

Growth is key while investing in companies for wealth creation. In this blog, we cover 5 such aspiring companies where management has shown an intent for quantifiable growth

Management Guru Peter Drucker once said – “If you cannot measure it, you cannot manage it”.

This statement has been one of the key foundational ideas behind investing ideation process for me. Why? For a simple reason that we need to find companies who can outperforms peers on growth with a decent balance sheet, cashflow and available at a fair valuation. There are multiple ways to find such investing ideas and one of the ways is to look for companies with well-defined future vision for idea generation to be followed by a detailed research process to validation good historic execution.

In fact, when I blogged last time, I did talk about execution as one of key traits of good leaders who create enormous wealth for investors (You can read the full blog here: https://scientificinvesting.substack.com/p/betting-on-the-jockey-for-long-term

Every year and every quarter, I go through multiple annual reports, investor presentation and conference call transcripts to search for ideas with a well-defined growth vision. In this blog, I am sharing with you 5 of 20+ ideas we have Scientific Investing have identified in last 12 months (please note that idea generation is starting point of investing analysis, this has to be followed by a rigorous analysis with lots of filters, checks and balances prior to decision making). Here they are:

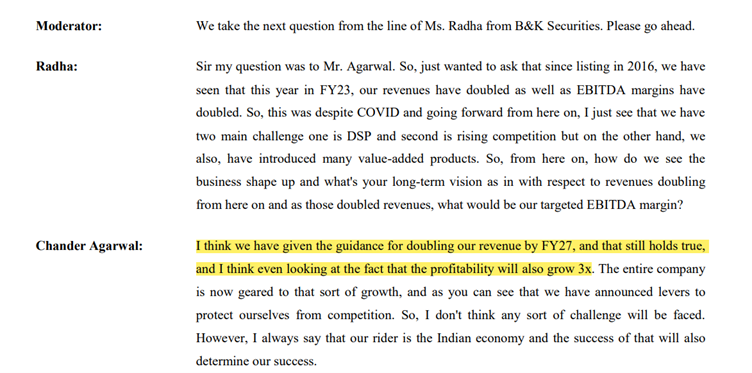

Company 1: TCI Express

https://www.bseindia.com/xml-data/corpfiling/AttachHis/d7ebc2d8-d0b5-4cbd-b913-9e60f51d767b.pdf

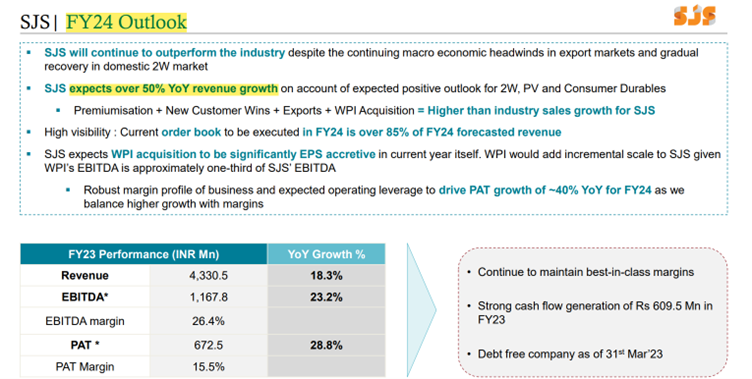

Company 2: SJS Enterprises

https://www.bseindia.com/xml-data/corpfiling/AttachHis/fc4ab9b9-1363-4d58-9ea6-2c4ac43ccdbd.pdf

We had earlier done analysis of this company on our YouTube channel. You may watch the same here:

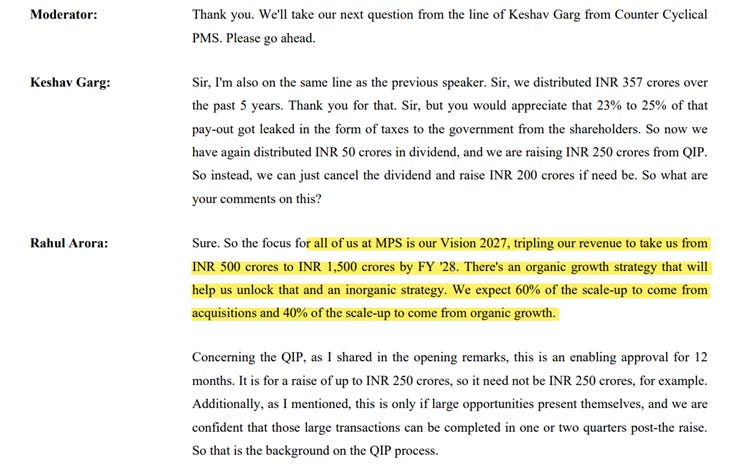

Company 3: MPS Ltd

https://www.bseindia.com/xml-data/corpfiling/AttachHis/e6ce9738-4145-4e1a-a52e-b384fe3adf4b.pdf

Company 4: VST Tillers

https://www.vsttractors.com/sites/default/files/2023-02/TranscriptFeb_13_2023.pdf

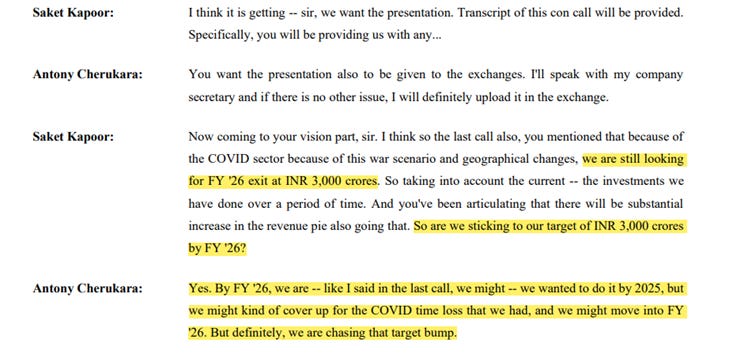

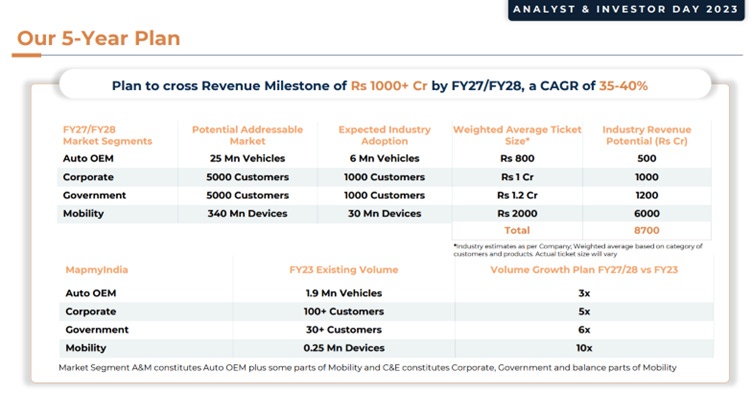

Company 5: MapMyindia (CE Infosystems)

https://www.bseindia.com/xml-data/corpfiling/AttachHis/b31856ca-2b47-445f-9bd2-09080be3658c.pdf

At Scientific Investing Practitioner membership, we keep doing such interesting studies in detail. Last year, in 12 months, we studied more than 50+ such interesting companies. Check here if you want to know more about our practitioner program: Annual Membership | Scientific Investing -Technofunda Algorithmic Trading

In the end, companies may or may not achieve the desired vision. However, tracking them over quarters, years and decades does help to build frameworks, checklists and mental models to separate men from boys and as an investor, this is something I keep doing on continuous basis. Hope this framework was useful to you.

Disc: I am a SEBI registered research analyst. I have transacted in some of these mentioned stocks in last 90 days. I may buy or reduce or completely sell some of these stocks without informing. Please do not take this article as stock advice. Please do your own research or contact your financial advisor.

https://mrmarketsidd.substack.com/p/maymyindia-ce-info-systems?sd=pf

Some notes about mapmyindia....

Best Analysis heart teaching your vedeos thanks a lot 🙏 😄