Betting on the Jockey for Long Term Sustainable Wealth Creation

It is important to invest in companies that have good leaders, but the question is how to identify good leaders. In this blog, we have tried to answer this question.

As an investor, the goal is to find great companies that can generate high returns. While there are several factors that contribute to a company's success, the role of leadership cannot be ignored. After all, it is the jockey who determines whether a horse wins the race or not. In this blog post, we will be discussing the importance of leadership and management in investing and how to identify great leaders.

Passion and Hunger for Growth

Leadership is an essential trait for any business to succeed. A good leader is someone who has the passion and hunger to grow their company sustainably. This is crucial because the market rewards growth, and if a company fails to grow sustainably, it is unlikely to perform well in the long run. Therefore, as an investor, look for leaders who are passionate and hungry about growth. However, the growth should not come at the cost of the balance sheet. We will talk more about it in the next sections. Also, what is a good growth rate? Our view is that the company should grow at least as fast as the market. Below is a snippet from the Newgen Technologies conference call transcript where management demonstrated passion and hunger for growth, but despite giving decent growth, management was not satisfied and felt there was scope for improvement.

The above comment comes despite the company doing a phenomenal job in the last few years on the growth front. This highlights certain important points:

Management has a track record of having passion and hunger for growth based on history and future aspirations.

Management is not complacent and is willing to investigate areas for improvement despite being a decent performer.

Execution Capability

The second trait of a good leader is having the execution capability to convert vision and passion into reality. Execution is all about getting things done. A good leader should be able to set clear goals, create a plan of action, and motivate their team to achieve those goals. They should also be able to make quick decisions and adapt to changing market conditions. Ultimately, execution is about delivering results, which is essential for a company's success. The leader needs to not only execute the vision and the passion into reality., but also have the capability to execute their vision. Here is a snippet from the annual reports of Apl Apollo that highlights its razor-sharp execution capability. In the last 12–13 years, management has scaled up its business with strong execution, aggressively grabbing market share from peers.

Capital Allocation Skill

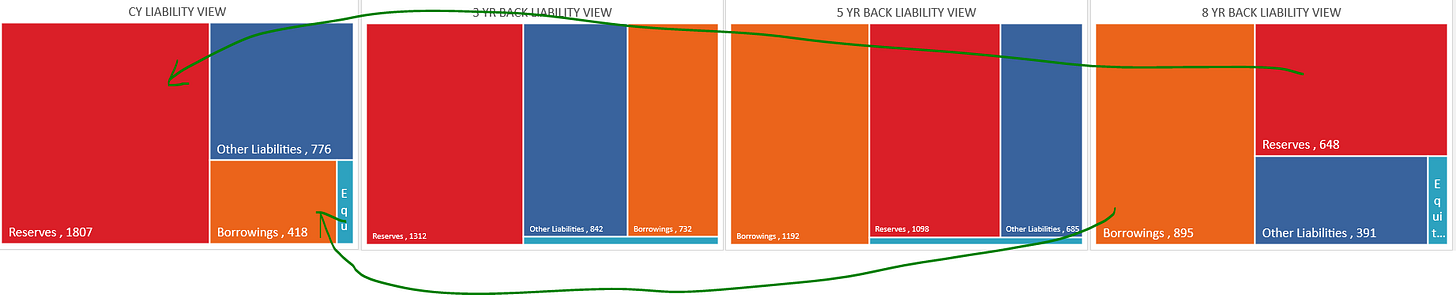

The third crucial aspect of leadership is capital allocation. In a bull market, it is easy for companies to grow, but it is important to do so sustainably without diluting the quality of cash flows or return on capital. A great leader should have the skill to allocate capital effectively, whether it is through investments in research and development or acquisitions. Here is the last 10-year performance of a company in the commodity space where management has been able to improve its cash flows, strengthen its balance sheet, grow at a reasonable rate without compromising on capital allocation, and has been continuously improving its return ratios when we look at numbers over 10, 5, 3, and last year. Surya Roshni’s return on equity has shown continuous improvement over the years with improved cashflows and a strengthened balance sheet.

Attitude towards Minority Shareholders

However, all of this could be of no use if the attitude of promoters and management towards shareholders is not transparent and honest. So, a good leader must have the right attitude towards minority shareholders. After doing all the good work, minority shareholders must be able to reap the rewards. Frequent equity dilution, a high level of related party transactions, a complicated company structure with a lot of mergers and acquisitions, etc. are some of the ways management fools minority shareholders and deprives them of what they deserve. Investors must maintain caution even with remote signs of these possibilities.

Identifying a Good Leader in companies with an without history

The framework, therefore, for identifying a good leader is to look for these things: passion and hunger for growth, execution capability, and the right capital allocation skill. The attitude towards minority shareholders should also be taken into consideration.

When it comes to evaluating leadership, historical performance is often used as a benchmark. However, in the case of newly listed companies, this can be challenging. So how can we evaluate leadership when there is not much historical data available? In such cases, we can look for certain statements made by the company's management or promoter that demonstrate their vision, passion, and execution ability. These statements can give us valuable insights into their leadership style and the direction in which they plan to take the company.

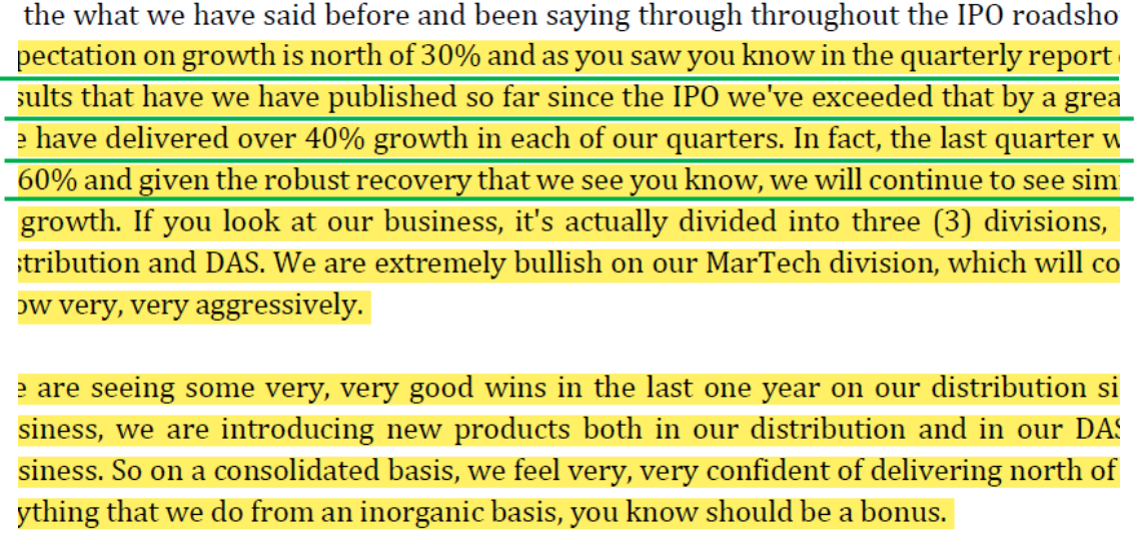

Now let us look at an example of a company with a smaller listing history. This company caught my attention despite having only two years of history. The reasons for this were not only business-related, but also due to the leadership skills of the promoter. Let us take a closer look at the unique leadership skills of Bhanu Chopra, CEO of a promising tech company. The company caught my attention not just because of its impressive financial numbers and industry sector, but also because of Chopra's distinct approach to leadership.

At a recent AGM, he emphasized the importance of valuations, stating that the company does not want to acquire other businesses just because it has cash on hand. Instead, Chopra stresses the need to pay the right valuation and remain focused on the US and European markets. This is particularly significant considering the recent tech meltdown, which has created opportunities for companies like Chopra's to acquire others with good capital allocation skills.

One of Chopra's key strengths is his passion for growth, which is reflected in the company's continuous innovation and execution. They have consistently exceeded their growth projections, even outpacing the market rate.

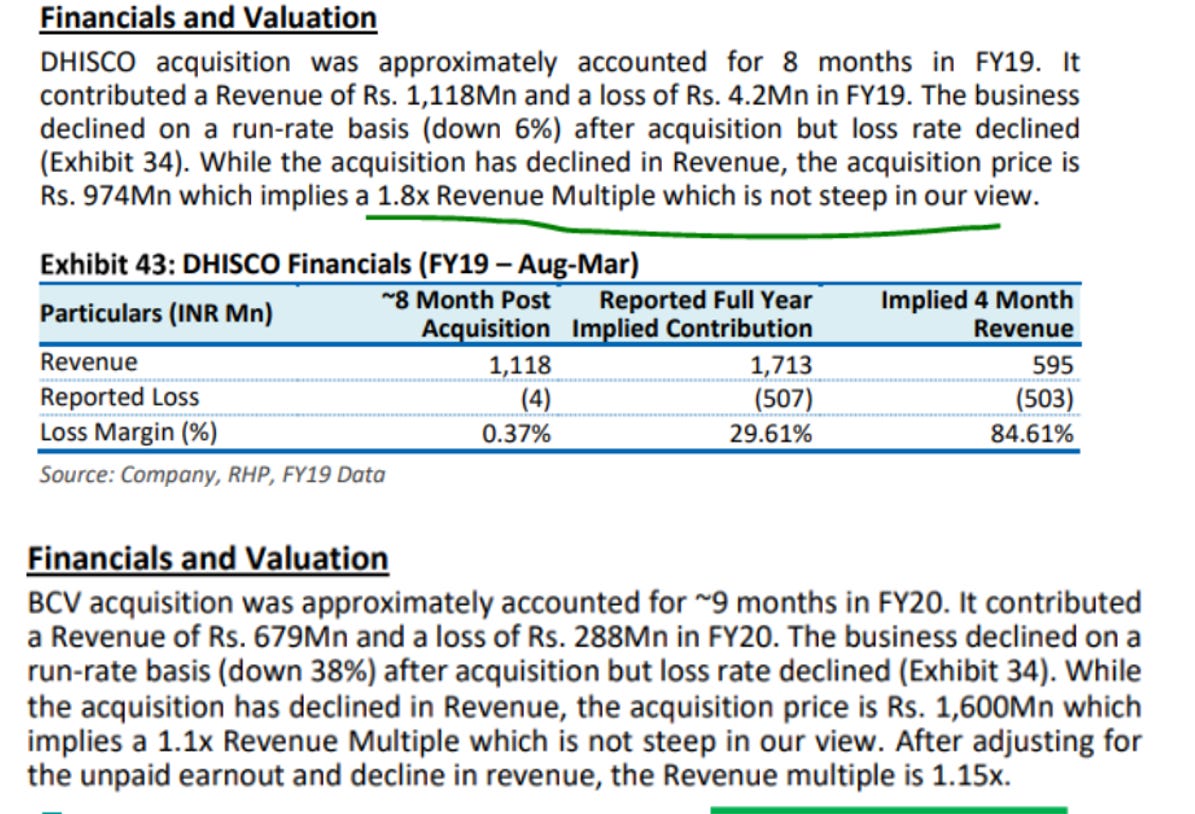

Despite being a tech IPO company, Chopra has not rushed to sell his shares, still holding over 62%. Instead, much of the money raised has been used for business purposes, including previous acquisitions. In fact, the company has a history of making smart acquisitions at modest revenue multiples, such as 1.5, 1.17, and 1.8

.

Chopra's approach to acquisitions is particularly notable, as he seeks to acquire companies at his own terms and conditions, without overpaying. Recently, the company acquired just 0.6 times its sales. This approach ensures that even if an acquisition does not go as planned, the chances of losing are lower

Overall, Chopra's unique leadership skills and his focus on smart acquisitions at reasonable valuations make his company an exciting one to watch in the tech industry.

Conclusion

To sum up, as an investor, it is important to invest in companies that have good leaders who possess the skills to grow the company sustainably. Look for leaders who have passion and hunger for growth, execution capability, and the right capital allocation skills. Consider their attitude towards minority shareholders as well. By identifying good leaders, investors can increase their chances of investing in successful companies.

Ultimately, it is the leadership that makes the difference between a good company and a great one.

We study multiple interesting management styles and companies. Join our practitioner membership to learn more: https://learn.scientificinvesting.in/annual-membership