The Most Efficient Hospital Business

Vaishnavi from Scientific Investing deep dives into hospital sector, analysing business and financial economies of various companies, focusing on one specific company - Kovai Medical Center & Hospital

“For he who has health has hope; and he who has hope has everything.”

– Owen Arthur

Standing out as a key player in its region, this healthcare provider has carved a niche for itself with a focus on accessible and efficient healthcare services. While smaller in scale compared to its national peers, it has consistently showcased financial stability and strong operational metrics. Its emphasis on cost-effectiveness ensures it remains a trusted choice for its local population.

The hospital maintains a solid balance sheet, reflecting efficient capital management and steady financial performance. Its return ratios, such as ROE and ROCE, are competitive within the sector, showcasing its ability to manage resources effectively. While it operates in a regional capacity, its consistent financial performance and operational efficiency underline its role as a key player in its market segment.

Let’s look at the financial history of this company:

● Revenue has grown by more than 10% every year in the last 10 years, barring two years: March 2019 and March 2021. In March 2019, revenue growth was 7% due to a decrease in the number of inpatients. In March 2021 (a COVID year), revenue declined by -3% because of reductions in operating beds and both inpatients and outpatients.

● Gross, EBITDA, and net margins have been stable and upward trending over the last 10 years. Return ratios are good, consistently above 15%.

● CFO/EBITDA and CFO/PAT are very healthy, indicating the company's ability to convert profits into cash. Depreciation as a percentage of sales has increased in the last 5-6 years due to significant capex, with sales growing in double digits since last 3 years

● Employee costs as a percentage of sales have remained stable. Contingent liabilities as a percentage of net worth have increased significantly in FY24.

● Debt/equity and Debt/EBITDA ratios have decreased. In FY24, the company further reduced its debt from 511 crores to 310 crores, however has increased it to 420 crores as of Sep 2024

● The interest coverage ratio is well above 4.5 and has increased to 7.5 in FY24 with significant debt reduction.

Kovai Medical Center & Hospital (KMCH)

Promoter’s Vision: Serving the Community

Dr. Nalla G Palaniswami, KMCH’s founder, has always emphasized community service. Coming from humble beginnings, Dr. Palaniswami is deeply committed to healthcare access for all, often providing free or concessional treatments to those in need. This philanthropic approach has led KMCH to stand out as a socially responsible healthcare provider, embodying a mission to ensure that advanced healthcare is accessible to everyone. He has always nurtured a deep-seated desire to serve the people of his homeland. While pursuing his studies in the US, he took the opportunity to visit numerous hospitals, leaving him awestruck by the advanced technology they offered. Motivated by this experience, he resolved to establish a super-specialty hospital in his native area, equipped with the same advanced medical capabilities found in overseas healthcare institutions. Driven by his conviction that education and healthcare should be universally accessible, he has ensured that his Medical College hospital extends its services to the underprivileged, offering free or concessional treatments, underscoring his dedication to serving the broader community.

Industry Overview: A Rapidly Evolving Healthcare Sector

The healthcare sector in India is experiencing rapid growth, with significant investments from both the public and private sectors. In FY21, the hospital sector recorded revenue of INR 7,940 billion, and it is projected to reach INR 18,348 billion by FY27, reflecting a CAGR of 18.24%. Additionally, reports indicate that the e-health market in India could generate revenue of $10.6 billion by 2025. The COVID-19 pandemic has accelerated the adoption of technological advancements in healthcare, further driving the sector's growth. India's healthcare system is characterized by efficiency and affordability, boasting skilled doctors, specialists, and nurses. Despite these strengths, the healthcare industry in India remains highly under-penetrated, signaling ample opportunities for expansion and development.

The Indian government is on a mission to establish the country as a global healthcare hub, dedicating ₹89,155 crore (US$10.76 billion) to the Ministry of Health in the 2023-24 budget. Key allocations include ₹3,365 crore for PMSSY, ₹6,500 crore for medical education, ₹29,085 crore for the National Health Mission, and ₹7,200 crore for the Ayushman Bharat health insurance scheme. With growing affordability and support from Ayushman Bharat, India's healthcare industry is expected to see a robust 13-15% growth between FY23 and FY26, positioning it for major global influence.

Peer Analysis

1. Average Revenue Per Occupied Bed (ARPOB):

● This metric reflects the average revenue generated per bed when it is occupied. Fortis Healthcare has the highest ARPOB at ₹60,887, indicating a focus on high-value services targeted at premium markets.

● In contrast, Kovai Medical Center & Hospital has the lowest ARPOB at ₹20,173, reflecting its focus on affordability and catering to a wider population segment. As a regional hospital, KMCH prioritizes accessibility over premium pricing, which aligns with its mission to provide cost-effective care. While its ARPOB is lower compared to peers, it strategically positions KMCH as a community-friendly healthcare provider.

2. Occupancy Rates (OR):

● The occupancy rate (OR) indicates the percentage of available beds occupied by patients. Aster DM Healthcare has the highest OR at 68%, showcasing efficient utilization of its resources.

● Kovai Medical Center & Hospital, along with Narayana Hrudayalaya, has an OR of 60%. This slightly lower utilization rate reflects KMCH's smaller scale as a regional hospital, serving a more localized population compared to national and international players like Apollo and Fortis. However, this stable OR provides a foundation for further growth in patient volumes.

3. Average Length of Stay (ALOS):

● ALOS measures the average number of days a patient stays in the hospital. Narayana Hrudayalaya has the longest ALOS at 4.4 days, focusing on complex or critical care, while Apollo Hospitals has the shortest ALOS at 3.3 days, emphasizing shorter treatments and high patient turnover.

● KMCH’s ALOS of 4.0 days reflects a balance between acute and chronic care, aligning with its role as a regional hospital catering to diverse patient needs. This metric highlights KMCH’s capability to manage both short-term treatments and longer, more intensive cases efficiently.

4. Bed Capacity:

● Apollo Hospitals leads in bed capacity with 9,500 beds, followed by Narayana Hrudayalaya (6,074), Aster DM Healthcare (4,867), and Fortis Healthcare (4,500). These hospitals are large-scale, multi-regional players with substantial infrastructure to cater to vast patient populations.

● KMCH, on the other hand, operates with a smaller bed capacity of 1,975, making it the smallest among its peers. However, its size is proportional to its focus as a regional hospital, ensuring personalized, patient-focused care and specialized services for the local community.

5. Correlation of Metrics:

● Larger hospitals like Fortis Healthcare and Apollo Hospitals, with higher ARPOB (₹60,887 and ₹57,488 respectively) and moderate OR (65%), balance premium services with efficient resource utilization.

● KMCH’s lower ARPOB and smaller scale reflect a different strategy, emphasizing affordability and regional accessibility. While KMCH’s OR (60%) and bed capacity are modest compared to larger players, its focus on community healthcare positions it well in its market segment.

6. Comparative Observations:

● Fortis Healthcare and Apollo Hospitals stand out as high-revenue generators with extensive infrastructure, focusing on premium, high-value care. Their operations are designed for large-scale patient handling and efficient turnovers.

● Narayana Hrudayalaya and Aster DM Healthcare occupy the mid-range category in terms of size and operations, combining moderate ARPOB and OR with more diversified care models.

● Kovai Medical Center & Hospital, being the smallest and a regional hospital, focuses on providing accessible, affordable care to its community. It competes effectively in its segment by leveraging its affordability and balanced metrics (such as ALOS and OR) to attract and retain patients. While KMCH operates on a smaller scale, its steady performance and commitment to community-centric healthcare set it apart in its niche.

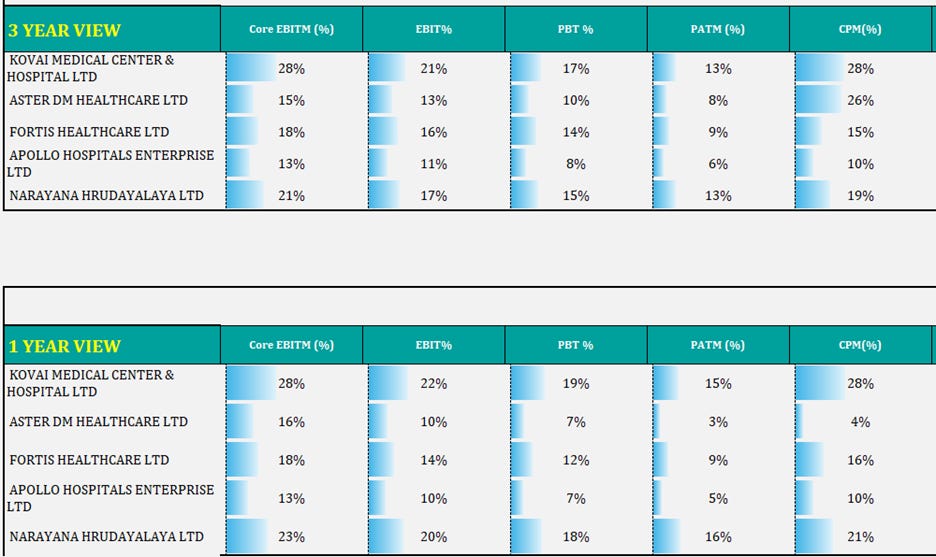

KMCH Leads in Profitability Across Timeframes:

● Kovai Medical Center & Hospital (KMCH) consistently outperforms peers in profitability with the highest Core EBITM (28% for 1-year and 3-year views, 27% for 5-year, and 25% for 8-year). Similarly, its EBIT (22% for 1-year, 21% for 3-year) reflects outstanding operational efficiency, surpassing larger peers like Fortis (14% EBIT in 1-year) and Apollo (10% EBIT in 1-year).

Superior Pre-Tax and Post-Tax Margins (PBT% and PATM%):

● KMCH achieves the highest PBT (19% in 1-year, 17% in 3-year) and strong PATM (15% in 1-year, 13% in 3-year), highlighting efficient cost and financial management. Among peers, only Narayana Hrudayalaya approaches similar levels (PBT: 18%, PATM: 16% for 1-year), while Aster DM (7% PBT, 3% PATM) and Apollo (7% PBT, 5% PATM) remain significantly lower.

Long-Term Stability in Profitability Metrics:

● Over an 8-year horizon, KMCH continues to dominate with Core EBITM (25%) and PBT (16%), reflecting sustainable growth and efficiency. Its PATM of 12% further solidifies its position as a consistent performer, outperforming larger peers like Apollo and Fortis (PATM of 4%-5%).

KMCH’s Regional Strength and Efficiency:

● Despite being a regional hospital, KMCH’s financial and operational efficiency surpasses larger, multi-regional players like Apollo and Fortis. Its focus on affordability and streamlined operations makes it a leader in profitability across its peer group, maintaining steady growth and stability.

Company Overview: Kovai Medical’s Regional Reach

Kovai Medical Center and Hospital Limited is a public company incorporated in the year 1985 and commenced its hospital operations in the year 1990 with the flagship Multi-Specialty Hospital in Coimbatore. Since then, it has established satellite centers in Coimbatore (City Center, Sulur Hospital, and Kovilpalayam Hospital) and in Erode (Erode Specialty Hospital). It stands as one of the largest hospitals in the region and operates under a hub-and-spoke model, with smaller satellite centers treating patients from surrounding regions. The peripheral hospitals, likely smaller in size, are associated with the main hospital.

It started MBBS educational activities with the commencement of the Medical College in the year 2019-20 under the title of KMCH Institute of Health Sciences & Research. As per the norms prescribed by the Government of India, a medical college can be established only with the concurrent establishment of a Medical College Hospital.

Verticals of the business

The revenue stream of KMCH has diversified across two sectors since the inception of the Medical College – Hospital Sector, contributing around 93% to the total revenue, and income from the Education Sector contributing around ~7% to the total revenue in FY24.

The Heart of KMCH: Hospital Services

KMCH operates a multispecialty hospital with 854 operating beds at Coimbatore equipped with latest tertiary health care facilities. The company also has its satellite centers at Ramnagar, Coimbatore (51 beds), Erode (103 beds), Sulur (111 beds) and Kovilpalayam (193 beds) including beds for ICUs, dialysis ward, etc. Additionally, KMCH oversees a medical college and hospital, inaugurated in phases from October 2018 to April 2023, with a total of 750 beds.

The primary hospital, situated in Coimbatore, offers an extensive range of services across approximately 40 specialties, including Urology, Cardiology, Gynecology, Orthopedics, and Neurology, among others. The main hospital at Coimbatore continued to be the major contributor to KMCH’s revenues with 70-75% of total revenue coming from this center. Renowned as one of the largest healthcare institutions in the Coimbatore region, the hospital operates on a hub-and-spoke model, with smaller satellite centers extending its reach to patients from surrounding areas. These peripheral hospitals, though smaller in scale, are closely aligned with the main hospital's operations. The company's revenue stream reflects a diversified portfolio across various specialties, with Neurology and Cardiology emerging as significant contributors, jointly comprising 29% of the revenue in FY24. Notably, none of the specialties contributed more than 20% of revenue and top five departments contributed around 53% to total sales.

Capacity expansion -

The company has been able to grow its bed capacity by 63% from FY19-FY24 in line with growth in in-patient numbers growing at 47% and out-patient numbers by 59%.

Occupancy rates -

● The decrease in occupancy from FY18 to FY19 is due to the decrease in the number of in-patients, and the number of operating beds also has not increased much.

● From FY19 to FY20, the occupancy rates decreased because even though there was an increase in the operating beds and the number of in-patients, the ALOS has decreased significantly.

● The decrease in occupancy from FY20 to FY21 was because there was a significant decline in the number of in-patients and operating beds (COVID year).

● From FY21 to FY22, the decrease was because there was a sharp increase in the number of operating beds, but the growth in the number of in-patients was not at the same pace.

● The occupancy rates have increased from FY22 to FY23 because in-patient numbers and ALOS are catching up.

● For FY24, the occupancy rate has increased standing at 60% with reduction in operating beds capacity

Average Revenue per Occupied Bed-

The Average Revenue per Occupied Bed has fallen significantly from FY22 to FY23. The overall ARPOB of KMCH reduced in FY23 to ₹17,442 from ₹21,144 in FY22. This reduction is on account of the increased contribution from medical college hospitals, where ARPOB is lower than the main hospital. However, in FY24, the ARPOB has improved along with an increase in average revenue from in-patients and out-patients.

Reason for low ARPOB in Medical College Hospital -

Source - AR Report 2023

Let’s look at the financials of the Healthcare segment

Is there growth potential in the hospital segment, and if so, from where?

KMCH is expanding its horizons with a 300-bed multi-specialty hospital in Chennai, a project with a capex of ₹300 crore, slated for completion within 18–24 months. This strategic move aims to strengthen KMCH’s brand and create new growth avenues, positioning it well in Chennai’s competitive healthcare landscape. The Chairman believes that by offering high-quality services at reasonable prices, KMCH can thrive alongside established players. Back at its main center, KMCH is setting up a dedicated children’s hospital and increasing capacity to a potential 2,500 beds. Additionally, with the relocation of the nursing college, the main center is adding 100 private rooms. In the future, KMCH may explore further expansion within Coimbatore or other cities as promising opportunities arise.

Education: Building a Legacy of Healthcare Professionals

The company started MBBS educational activities with the commencement of the Medical College in the year 2019-20 under the title of KMCH Institute of Health Sciences & Research. As per government norms, they also set up a 750-bed medical college and hospital adjacent to the existing main hospital at a total cost of Rs. 670 crores. The medical college hospital has 750 general beds, including 50 ICU beds, 30 emergency beds, and 16 operating theaters.

Let us calculate revenue potential from MBBS College -

Admissions are overseen by the Directorate of Medical Education, with no college having the authority to bypass any candidate in the process. NEET scores serve as the basis for counseling. In private colleges, government-fixed fees apply to 65% of seats, as determined by the Directorate of Medical Education. The remaining 35% are subject to fees set by the college management. If Kovai Medical College intends to levy higher fees, it may do so for the 35% of seats solely on the premise of providing quality education, contingent upon public perception of it as a reputable institution. Kovai can set fees for 100% of seats if it expands with multiple campuses affiliated with the same university or applies for deemed to be university status. However, to do so, they will have to increase their capacity. They currently have an annual intake capacity of 150, and they cannot increase it to 200 or 250 due to the reasons mentioned below.

Source - MBBS council.com

For 65% of the seats government fees are applicable: 750*65%*4,35,000 =21,20,62,500.

For 35% of the students management fees are applicable: 750*35%*13,50,000= 35,43,75,000.

Note - For simplicity of the calculation we have not taken NRI/OCI fees, also there might be other fees such as admission fee, processing fee, hostel and mess fee etc.

Kovai Allied Health Sciences

They have another educational institute by the name of Allied Health Sciences This institute offers 12 UG programmes and 4 PG programmes, UG programmes for those who have done their intermediate in Biology, Physics and Chemistry.

Since the hospital has all kinds of clinical setup, the Allied Health Science Programmes conducted in the KMCH has a unique nature. The clinical training and exposure given to the students of AHS are helping them to become the best and competent Professionals.

Let us calculate the revenue potential from the Allied Health Sciences Institute -

From 2019 to 2024, the number of students has consistently ranged between 650 and 750, with the maximum capacity for AHS courses being 2500 students. The number of students in FY-24 was 738, and the fee structure for these courses ranges between ₹50,000 and ₹80,000 depending on the course.

So, for FY-24: 738 * ₹65,000 = ₹4,79,70,000.

At maximum capacity (2500 students): 2500 * ₹65,000 = ₹16,25,00,000.

Hence, the revenue potential is not as high.

Note: The above calculations are based on assumptions to provide an approximate figure. Overall, the educational services segment from both institutes can generate high cash flows for the business. However, there is no significant headroom for growth.

Is the educational segment benefiting the healthcare segment in the long term?

We know India faces a significant shortage of doctors, and through this medical college, the hospital can attract quality medical professionals. With appropriate training and experience, these doctors can make substantial contributions to the profitability of the business.

Qualitative analysis and insights

Some excerpts from the Annual Report - 2024

Promoter's Statements on Charitable Contributions and Healthcare Accessibility

● I always say I want to serve the people of my land. I write off about Rs. 10 Crores in Revenue every year for people who come and request for it. I think I’m the only Chairman of a hospital that does this. Because I also came from a poor family, I know their difficulties.

● ‘Education for All’ and ‘Health for All’ are two major subjects for a nation. In India, the biggest difficulty is that - the reason behind Private Sector growth in these two spaces is that the government did not allocate sufficient resources. When it comes to ‘Health for All’, either there should be a good insurance system or the government should subsidize it.

● The motto at KMCH is to make sure that all the advanced medical technology should be available to our people too i.e. in their region. Since we buy all the latest equipment and technologies, we incur a lot of expense. So, we are forced to charge money but I wish that everyone should be able to access good healthcare, regardless of whether he is rich or poor.

The promoters of KMCH, Dr. Nalla G Palaniswami (Managing Director and Chairman) and Dr. Thavamani Devi Palaniswami (Joint Managing Director), have over four decades of experience in the medical field, spanning both the USA and India. Actively engaged in the hospital's day-to-day operations, they are supported by a proficient and seasoned management team. Dr. Arun N Palaniswami, the eldest son of Mr. N. Palaniswami, serves as the Executive Director of the company, bringing with him 17 years of experience, including 9 years in the USA and 8 years in KMCH's Hospital Administration as Director of Quality Control. Positioned as the successor to his father, he is poised to carry forward the family's legacy. While the other two children of the Chairman hold position as non-independent directors within the company, their residence is in the USA, leading different work lives, and they are not involved in the day-to-day business operations of Kovai.

Valuations -

The stock is currently trading at around 14-15 times FY25 EV/EBITDA, but in the past, it has traded at 7-10 times EV/EBITDA. There are multiple reasons for this rerating such as growth, financial metrics, and return ratios have been phenomenal. One recent interesting development is that the company has indicated a capex in the Chennai hospital, which shows signs of expansion from the management. If the management is able to successfully execute new projects and improve disclosures, there is a chance that the stock might not go back to single-digit EV/EBITDA. What are your thoughts on valuations? Please share in the comment section.

Risks

● Geographical concentration of revenues: KMCH has been in operation for around 30 years and continues to enjoy patronage in the Coimbatore region. The revenue profile of KMCH is heavily dependent on the main hospital in Coimbatore, which contributed around 79% of total revenue in FY23, 78% in FY22, and around 74% in FY21. Over the past few years, they have started peripheral centers in nearby areas, and the company has successfully set up a medical college comprising 750 hospital beds. However, as we discussed, the revenue potential is not that high, and the company doesn’t seem to have any geographical expansion plans as well.

● The provision of free and concessional treatments is impacting ARPOB: All in all, from a societal standpoint, the promoters are doing an exceptional job. However, because of the free treatments and discounts being offered in the medical college hospital, the overall ARPOB is being impacted.

● Increase in insurance penetration: A higher-than-expected increase in insurance penetration would affect the margins of the hospital as a whole.

Lack of institutional interest, poor disclosures, and no investor presentations, con-calls, interviews etc.

Source: CARE Report

Summary

KMCH represents a combination of healthcare excellence and a strong commitment to community welfare. Under the guidance of a visionary management team, the hospital has achieved significant growth while continuing to prioritize affordable and quality healthcare services. Its valuations remain relatively cheap, primarily due to its status as a regional hospital. However, there is potential for a re-rating in the future if the management successfully executes its planned expansion into Chennai and enhances its corporate disclosures.

While its provision of free services may have a slight impact on margins, this commitment to social impact strengthens its brand and reinforces its position as a trusted healthcare provider in the region.

Join Scientific Investing 2-Day Technofunda Workshop

All the details about workshop: https://learn.scientificinvesting.in/webinar

Link to Register: https://pages.razorpay.com/pl_P2BkoOdCqFYP5b/view

Join Scientific PRACTITIONER + SIMBA Subscription

All the details about PRACTITIONER + SIMBA subscription:

https://learn.scientificinvesting.in/

Link to Register: https://learn.scientificinvesting.in/learn/PRACTITIONER

DISCLAIMER : Please note these documents are intended to initiate academic curiosity and help understand any business at a 1st level, encouraging the right questions. This information should not be considered as a buy or sell recommendation. We publish multiple such academic documents/contents, and anything published by Scientific Investing should be considered only for educational purposes and not a buy or sell recommendation. Kumar Saurabh, founder, Scientific Investing, is also director at Technofunda Ventures Private Limited. Techno- funda Ventures Private Limited is registered with SEBI under SEBI (Research Analyst) regulations, 2014 with registration number INH000012272.This content here is meant purely for educational purposes and not meant for any investment or trading purposes and kindly do not consider it as advice or recommendation. The companies discussed may or may not be part of our portfolio, and we may buy or sell any holdings without prior notice.

Hence ebitda growth CAGR could be the future returns. Less chances of derating unless some major wrong capital allocation

Multiple is fairly priced for current profits.