Quarterly Business Bytes – Q3FY23

Investing is all about reading, analyzing and connecting the dots through multiple layers of thinking. When it comes to reading, conference calls are one of the best ways to build deeper understanding

Market bas 3 cheez pe chalta hai – Demand, Demand, Demand

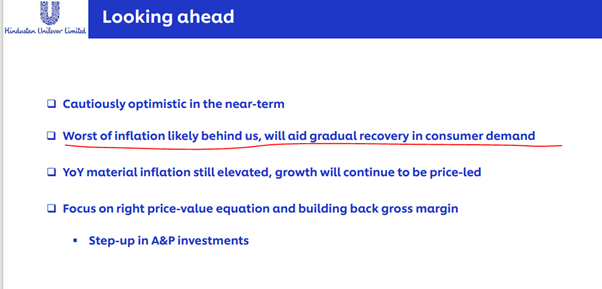

Sluggish consumer demand has been the talk of the town, however, management commentary has been mixed, with some still highlighting the impact and others saying the worst may be behind them.

Not all correlations are easy to find

Ever wondered when housing sales go aggressively up, why it does not lead to immediate rise in sales of fans. Not all correlations are immediate and comes the lag effect of correlation. The lag effect of housing industry on the FMEG sector is approximately 24 months, as per a Crompton conference call.

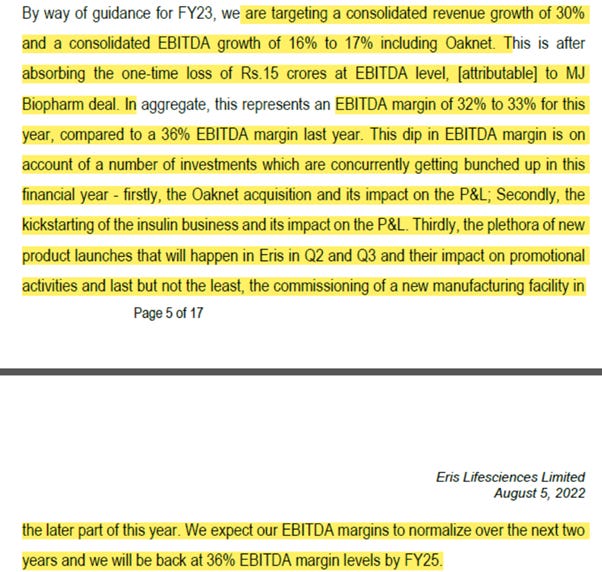

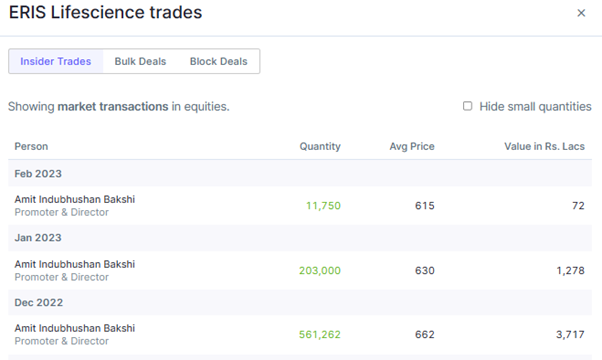

Pharma – Relieving pain to giving pain

Though pharma stocks are going through major corrections and huge pain, in a few names, promoter buying is going on with some interesting growth guidance in conference calls. There is, however, no momentum in the stock, so not much is said on social media. It may be worth to research for those who like to search for value and access possible business risks.

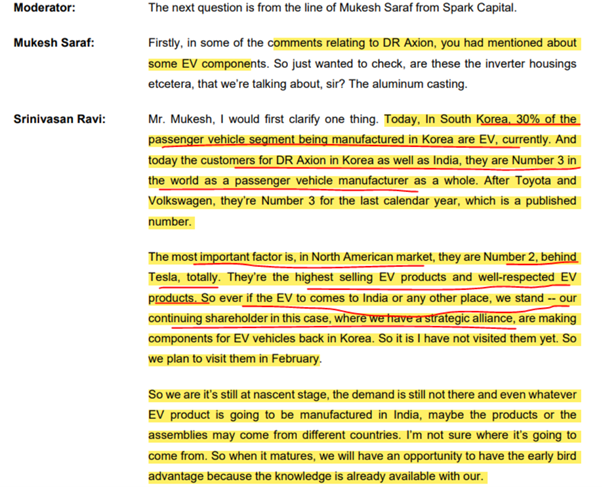

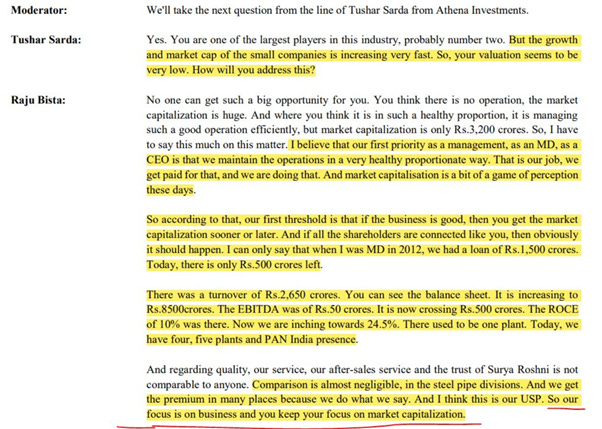

It is all about the jockey

Bytes on management thinking on various topics related to strategic alliance, acquisition, strategy, business performance, share price performance, valuation and market capitalization. From two companies covered earlier during our webinars – Craftsman Automation and Surya Roshni.

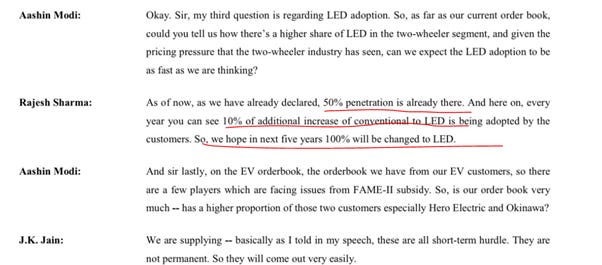

Trend is your friend – Both on charts and in business

One of the key trends in the auto sector is LED adoption. Here from Fiem industry conference call – in next 5 years, 100% LED adoption which means higher revenue opportunity per vehicle.

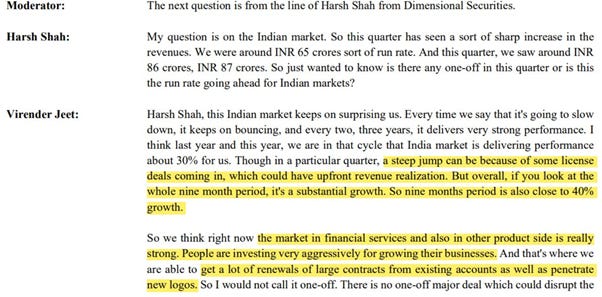

When A tells you about B

When IT sector company tells you current state of financial sector in India (yea, Scientific Investing played this theme right from early 2022, watch our Youtube space and twitter handle where we covered it detail at right time)

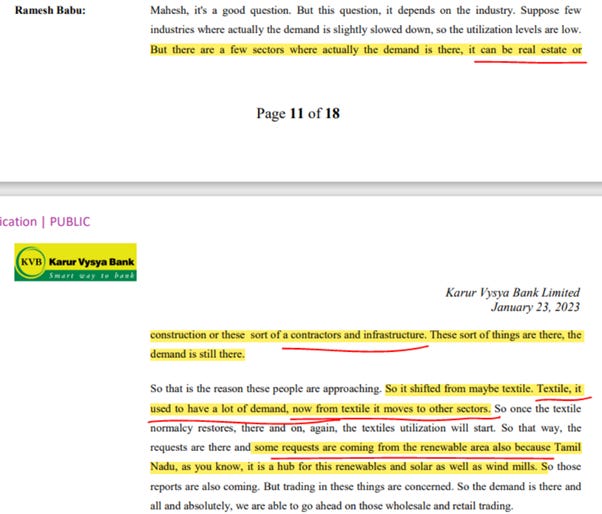

When B tells you about A

Reverse it and when the financial sector says about the health of other sectors in India. Kotak conference calls are the go to place for the same. But here, some snippets from the Karur Vyasya Bank conference call. No wonder textile stocks are losing all their strength and quite few infra stocks are showing a lot of strength. connecting the dots.

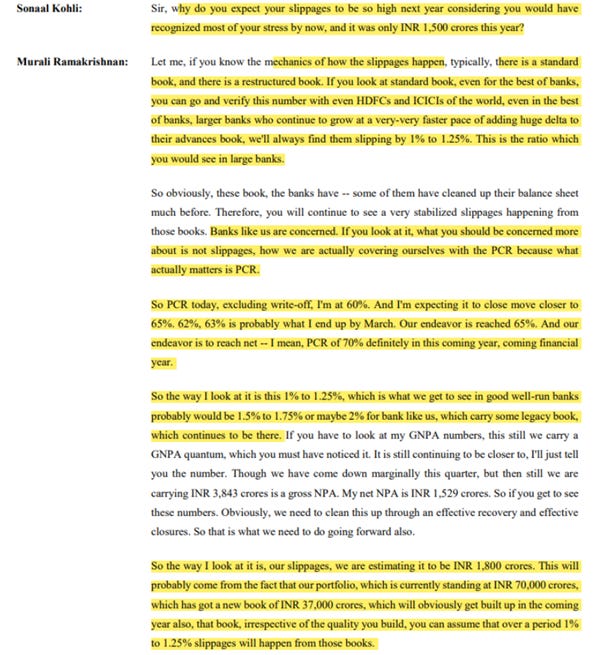

Ye banking banking kya hai, ye banking banking

Banking 101 in South Indian Bank conference call covering slippages, NPA, PCR and P&L work in general, for premium vs rest of banks. We suggest you read the whole conference call transcript to learn more.

Some of our year-old videos on banks on our Youtube channel:

Kal momentum, aaj ka ICU

If you remember our Q2 blog, APIs were in ICU. They are still not out but we are studying their behavior in ICU (expect a webinar soon, work is going in full flow because when stocks go in ICU, we like to read and be prepared)

IT -We know which levers to tune when and why customers do not leave us

Levers of margin management by IT companies– Utilization, Attrition, Offshoring, Billing, Automation and what drives customer stickiness in product companies (Hey, we are doing a super session covering IT sector – my bread-and-butter sector for a decade and platform companies in detail, register details are below)

Scientific Investing Super Session on "Information Technology & Platforms". Will have 2 sessions 3 hour each given width & depth of content. Recording will be provided. Event is covered for practitioner members

Register here: https://t.co/lQRwueYbj6

We hope that these 10 pointed insights helped you gain useful business knowledge. Do let us know your views and feedback. Also, subscribe to our newsletter for more such posts. Like, share, and help us reach more folks. I'll see you soon with another informative bite.

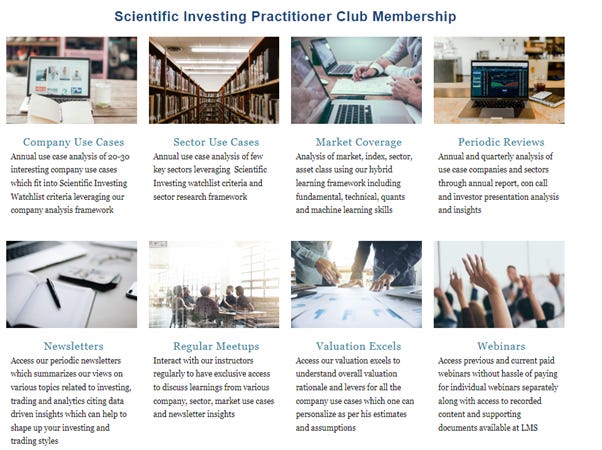

At Scientific Investing, we run an annual practitioner subscription where we discuss such business insights at 100x scale through stock and sector case studies, weekly community meetups, webinars, super sessions, guest sessions, etc. Check out this link to learn more about it:

https://learn.scientificinvesting.in/learn/SI-PRACTITIONER-MEMBERSHIP

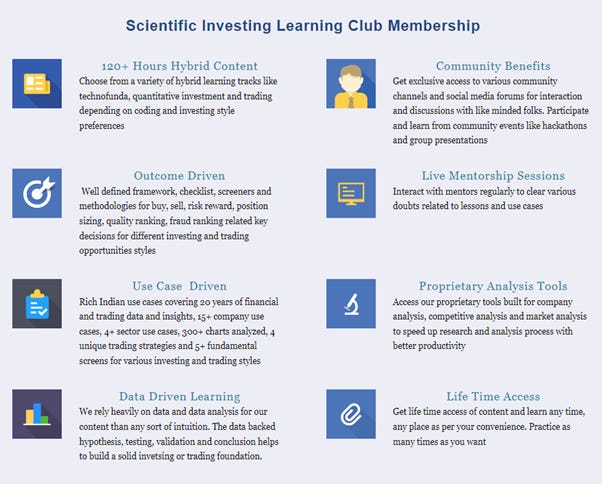

At Scientific Investing, we teach fundamental analysis, technical analysis, quantitative investing, and much more. Click here to learn more about us:

https://learn.scientificinvesting.in

We hope that these 10 points of insight helped you gain useful business knowledge. Do let us know your views and feedback. Also, subscribe to our newsletter for more such posts. Like, share, and help us reach to more folks. See you soon with another informative bite.