Quarterly Business Bytes – Q2FY23

Investing is all about reading, analyzing and connecting the dots through multiple layers of thinking. From 70+ conference calls we read this quarter, we bring 10 most interesting insights for you

Attrition in Indian IT sector has peaked out and abnormal salary increase is history

Source: HCL Technologies

Source: TCS

Though IT says all is well all is well in Europe, other industries have a different point of view

Source: TCS

Source: L&T Technology Services

Source: BKT Tyres

Source: Sudarshan Chemicals

USA mortgage market is in a poor state due to aggressive interest stand by fed to counter inflation

Source: Firstsource

API, Pigment, Chemical and surfactant driven companies by raw material or revenue going through various issues impacting business growth

Source: Galaxy Surfactants

Source: Supreme Industries

Inventory destocking and margin pressure across API and pigment companies leading to margin compression. Situation may bottom out in 1-3 quarters as per various managements

Source: Jubilant Ingrevia

Source: Aarti Drugs

As they say, “good news and good prices do not come together”. The best time to study a sector is when it is going through a temporary headwinds though structural tailwinds impact providing scope for margin of safety. At SOIC and Scientific Investing, we think it could be a good time to study API and Chemical sector. Something interesting coming up with dear friend Ishmohit (we had teamed up together earlier to simplify understanding of insurance sector)

However, not everything is gloom. Green shoots of high growth opportunity in electronics manufacturing industry

Source: Syrma

How EV adoption is expected to shapeup

Source: Gabriel

What it takes to generate higher margins in EV industry

Source: Sterling Tools

Freight costs may have topped out

Source: Sudarshan Chemicals

When you get insights about automotive sector trends in a banking sector conference call through lending linkages – lesser channel inventory in higher end car models

Source: Kotak Mahindra Bank

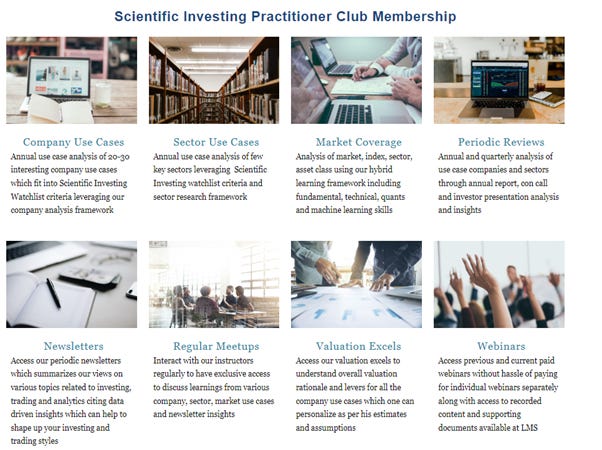

At scientific investing, we run an annual practitioner subscription where we discuss such business insights at 100x scale through stock and sector case studies, weekly community meetups, webinars and super sessions, guest sessions etc. Check this link to know more about it: https://learn.scientificinvesting.in/learn/SI-PRACTITIONER-MEMBERSHIP

At scientific Investing, we teach fundamental analysis, technical analysis, quantitative investing and much more. Click here to know more about us: https://learn.scientificinvesting.in

We hope that these pointed 10 insights helped you to gain useful business knowledge.

Do let us know your views and feedback. Also, share our newsletter with your friends.

See you soon with another informative bite